Have you ever wondered how you can protect your wealth and diversify your investment portfolio with gold? Over the past 50 years, gold has shown an average annual return of around 10%, making it a compelling option for investors. But when it comes to storing your gold, where and how you do it is just as crucial as the decision to invest in it.

There are various storage options available, each with its own set of advantages and drawbacks. From secure vault storage to keeping it close at home, every choice has implications for security, accessibility, and cost. Let’s take a look at these different gold storage options and find out which one might best suit your needs.

As a seasoned gold investor with over 40 years of experience, I understand the importance of making informed financial decisions and the trust you place in the information we provide. My goal for this blog is to keep you updated with the latest information, trends, and updates in the precious metals and gold IRA industries, so you can make your investment choices with confidence.

I don’t have much faith in banks, the monetary system, or politicians, and I prefer having more control over my money. In line with my beliefs, I’ll share opinions and findings from recognized financial experts, economists, and seasoned gold investors, citing these sources accurately to provide you with reliable and trustworthy information.

Let’s delve into the various gold storage options, ensuring you have all the information you need to make informed decisions about your gold investment strategies.

So, let’s explore these options together and find the best way to safeguard your wealth.

Key Takeaways

- Factors to consider when exploring gold investment and storage options: security, accessibility, insurance, cost, and reputation.

- Pros and cons of storing gold in a vault, at a bank, at home, or within an IRA.

- Importance of having control over financial investments for security and autonomy.

- The need to carefully evaluate gold investment and storage options to align with personal values and preferences.

- Taking control of one’s financial future for peace of mind and security.

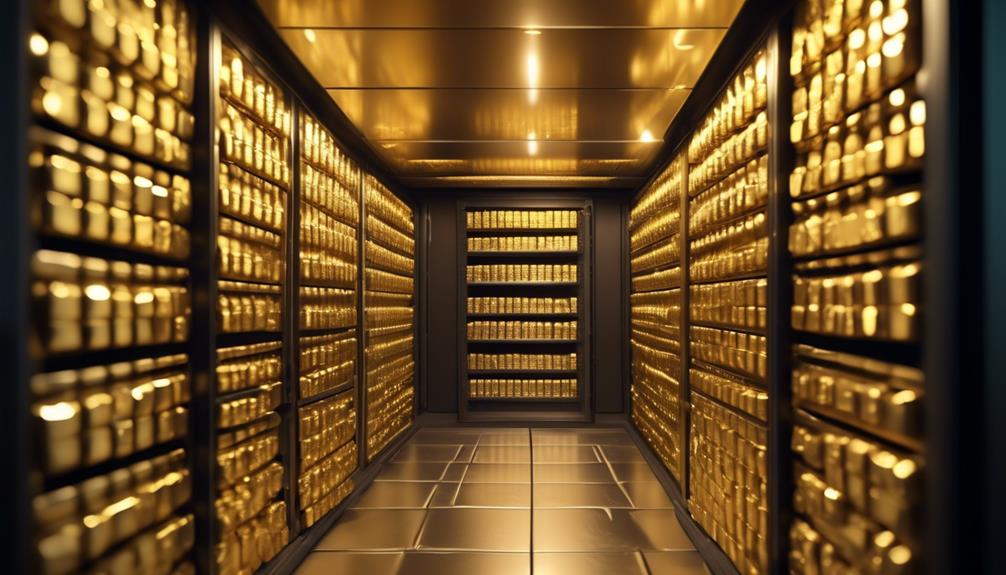

Gold Storage in a Vault

Storing gold in a secure vault is a top choice for those with substantial quantities of gold or seeking a hassle-free storage solution. The vault offers high levels of protection and insurance for your holdings, providing peace of mind and security that may not be achievable through home security measures.

Vault storage facilities such as Delaware Depository, Brinks, Texas Precious Metals Depository, and International Depository Services are popular choices for secure gold storage. These facilities offer high levels of security, insurance coverage, and professional accounting, making them reliable options for safeguarding your gold investments.

When selecting a vault for gold storage, it’s essential to consider factors such as security, insurance, accounting, access, and fees. Annual fees for vault storage can range from hundreds to thousands of dollars, so it’s crucial to weigh the costs against the benefits and level of service provided.

While direct access to your gold may not always be possible with vault storage, it remains a convenient and hands-off method for protecting and storing your valuable assets.

The purpose of this information is to help readers make informed decisions about the storage of their gold investments, ensuring that they’re well-protected and secure.

Gold Storage at the Bank

Storing your gold at a bank is a convenient and cost-effective option for safeguarding your precious metal holdings in a secure environment. It offers secure storage in safe deposit boxes, making it a less expensive alternative to storing gold in a private vault. Access to your physical gold is available during banking hours, ensuring convenient accessibility.

When considering this option, it’s important to factor in insurance, access hours, and security measures offered by the bank. However, it’s worth noting that safe-deposit boxes may have limited sizes, and not all banks offer them. Storing gold at a bank provides a secure location and the peace of mind that comes with third-party storage.

Consider these factors when determining the most suitable option for your gold storage needs.

Gold Storage at Home

When it comes to safeguarding your valuable gold at home, it’s wise to invest in a top-notch safe or vault with a UL rating and sturdy steel construction. This security measure is essential for protecting your precious metals from theft and other unforeseen events. Seasoned gold investors and financial experts recommend choosing a safe that offers maximum protection and discretion for your gold storage needs.

It’s crucial to keep your gold storage discreet and hidden from prying eyes, as this minimizes the risk of theft. Insuring your gold against theft, fire, and unexpected events is equally important, as it provides an added layer of security for your investment. Financial experts emphasize the significance of insuring your gold to mitigate potential losses.

When storing the safe at home, it’s advisable to select a secure and discreet location to ensure optimal protection for your gold. This precaution is in line with the advice of experts in the field, who emphasize the importance of strategic placement for enhanced security. Additionally, it’s essential to avoid storing gold or silver in areas prone to moisture, as this can lead to corrosion and damage over time.

Gold Storage for IRAs

When it comes to safeguarding your gold investment, it’s crucial to consider IRS-approved gold vault storage for IRAs. This type of storage provides high security and insurance for your precious metals, ensuring compliance with IRS regulations.

Home storage and safe-deposit boxes aren’t approved for gold storage in IRAs, and using personal homes for gold storage violates IRS rules. Instead, IRS-approved depositories like CNT Depository, Delaware Depository Service Company, Brinks Global Services, International Depository Services, and Dakota Depository Company offer secure and compliant storage options.

Reputable gold storage providers offer transparent information about how they store precious metals for IRAs and adhere to specific IRS rules. By selecting an IRS-approved depository, you can protect your precious metals and ensure they’re stored in the safest place possible.

Financial experts and seasoned gold investors emphasize the importance of choosing IRS-approved storage for gold in IRAs. This ensures the security and compliance necessary for protecting your investment.

3 Best Gold Storage Options

When it comes to storing your gold, you want to make sure you’re choosing the best option. Factors like security, accessibility, insurance coverage, costs, and the reputation of the storage provider all play a crucial role in this decision.

Let’s explore some top gold storage options and how they stack up.

Gold vault storage is known for its high security and insurance coverage, making it a top choice for storing large amounts of precious metals, especially for gold IRAs. However, keep in mind that there may be annual fees and limited direct access to your gold.

If you prefer a more hands-on approach, safe-deposit boxes at banks offer secure and convenient gold storage, usually at a lower cost compared to gold vault storage. Just be aware that these boxes have limitations on space, access, and insurance coverage.

For those interested in self-directed IRAs, it’s essential to follow specific IRS rules for gold storage. Storing gold at home isn’t recommended as it violates IRS regulations and may result in penalties.

When it comes to choosing a storage provider, there are several reputable options to consider, such as CNT Depository, Delaware Depository Service Company, Brinks Global Services, International Depository Services, and Dakota Depository Company. These IRS-approved depositories offer low fees, insurance coverage, and reliable customer service, making them excellent choices for safeguarding your precious metals.

Conclusion

In wrapping up, it’s vital to consider the factors of security, accessibility, insurance, cost, and reputation when exploring gold investment and storage options. Whether opting to store gold in a vault, at a bank, at home, or within an IRA, each choice has its pros and cons. It’s crucial to carefully assess each option and take into account specific needs and preferences before making a decision.

Given my skepticism towards banks, the monetary system, and politicians, I prefer having more control over my money. It’s important to have a sense of security and autonomy when it comes to financial investments.

In conclusion, it’s crucial to carefully evaluate the gold investment and storage options available to ensure they align with personal values and preferences. Taking control of one’s financial future is a powerful decision that can bring peace of mind and security.

Request your free gold information kit today to learn more.

The Gold Information Network

11900 Biscayne Blvd, Ste 127B, Miami, FL 33181

(305) 449-9094

http://goldinfo.net